How to Ensure Compliance with UK Business Regulations in 2024

Navigating the complex landscape of UK business regulations is a critical aspect of running a successful enterprise. Compliance ensures that businesses operate within the law, avoid hefty fines, and maintain a positive reputation. As we step into 2024, it’s essential to understand the key areas of compliance and the latest changes in regulations. This blog provides a comprehensive guide on how to ensure compliance with UK business regulations in 2024, complete with examples, actionable insights, and tables for better understanding.

Understanding the Regulatory Environment

The UK regulatory environment covers various aspects, including employment law, data protection, tax regulations, and industry-specific rules. Staying updated with changes in these areas is crucial for compliance.

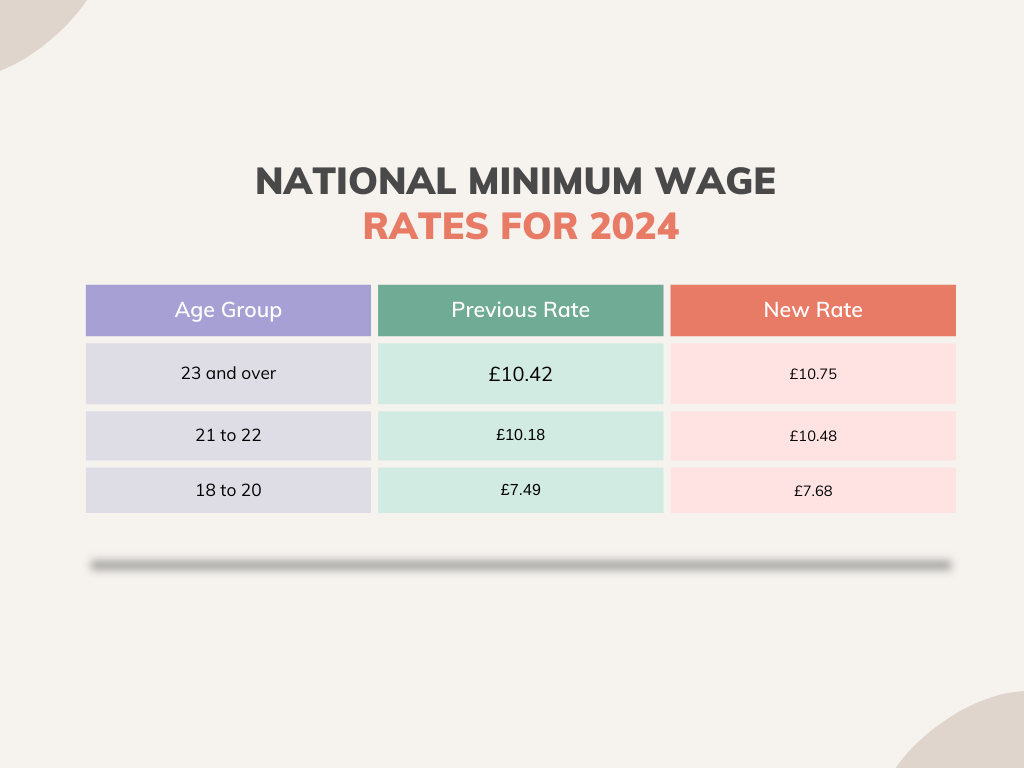

Employment law in the UK governs the relationship between employers and employees. Key areas include minimum wage, working hours, health and safety, and anti-discrimination laws. Example: In 2024, the UK government has introduced changes to the National Minimum Wage rates. Businesses must ensure that all employees are paid at least the minimum wage according to their age bracket. Failure to comply can result in significant penalties and damage to the company’s reputation.

Data Protection

The General Data Protection Regulation (GDPR) remains a cornerstone of data protection laws in the UK. Companies must handle personal data responsibly and ensure robust security measures. Example: A company that collects customer data must have clear consent mechanisms and data security protocols. In 2024, there are updates to GDPR enforcement, with stricter penalties for data breaches. Businesses should regularly audit their data protection practices to stay compliant

Implementation: Developers can use libraries such as TensorFlow.js to incorporate machine learning models directly into web applications. This enables real-time data processing and analysis, providing users with a more personalized and responsive experience.

Tax Regulations

Tax compliance involves understanding and adhering to various tax obligations, including corporation tax, VAT, and payroll taxes. Example: The UK government has introduced changes to VAT reporting in 2024, requiring businesses to use digital platforms for submitting VAT returns. Companies must ensure their accounting systems are updated to comply with these new requirements.

Example: The UK government has introduced changes to VAT reporting in 2024, requiring businesses to use digital platforms for submitting VAT returns. Companies must ensure their accounting systems are updated to comply with these new requirements.

Steps to Ensure Compliance

1. Stay Informed and Updated

Keeping abreast of regulatory changes is the first step towards compliance. Subscribe to updates from relevant regulatory bodies and industry associations. Actionable Tip: Appoint a compliance officer or team responsible for monitoring regulatory changes and disseminating information throughout the organization.

Implementation: Developers should adopt practices such as using HTTPS, implementing multi-factor authentication, encrypting sensitive data, and conducting regular security assessments to identify and address vulnerabilities.

2. Conduct Regular Audits

Regular compliance audits help identify potential issues before they become significant problems. Audits should cover all aspects of operations, from employment practices to data security. Example: A retail company conducts quarterly audits to ensure that all employees are receiving the correct wages and that their data protection measures meet GDPR standards.

3. Implement Comprehensive Training Programs

Training employees on compliance-related matters is essential. This includes understanding company policies, regulatory requirements, and reporting procedures. Actionable Tip: Develop an annual training schedule that covers all key areas of compliance. Use real-life scenarios and case studies to make the training more engaging and practical.

4. Leverage Technology

Technology can play a vital role in ensuring compliance. Use software solutions for tracking regulatory changes, managing data security, and maintaining accurate records. Example: A financial services firm uses a compliance management system to track changes in financial regulations, ensuring that all transactions are compliant and documented.

Industry-Specific Compliance

Different industries have unique regulatory requirements. Understanding and adhering to these is crucial for sector-specific compliance. Healthcare Healthcare providers must comply with regulations set by bodies such as the Care Quality Commission (CQC) and the General Medical Council (GMC). Example: A private clinic regularly updates its practices to comply with new CQC guidelines, ensuring patient safety and quality of care.

Financial Services The financial sector is heavily regulated by the Financial Conduct Authority (FCA). Compliance includes adhering to anti-money laundering (AML) laws and ensuring transparent financial practices. Example: A bank implements stringent AML procedures, including customer due diligence and regular transaction monitoring, to comply with FCA regulations.

Handling Compliance Breaches

Despite best efforts, compliance breaches can occur. Handling them effectively can mitigate damage and prevent recurrence. Prompt reporting of breaches to the relevant authorities is crucial. Immediate reporting not only demonstrates transparency and cooperation but also helps avoid higher penalties and loss of trust that can result from delayed reporting. For instance, a tech company that experiences a data breach promptly reports it to the Information Commissioner’s Office (ICO), showcasing its commitment to compliance and openness. Once a breach has been reported, conducting a thorough investigation is essential to understand the root cause of the incident. This investigation helps in identifying the gaps that led to the breach and in implementing corrective measures to prevent future occurrences. A practical approach is to form an internal task force dedicated to investigating breaches, recommending corrective actions, and documenting the findings and steps taken to address the issue. This systematic investigation ensures that all aspects of the breach are examined and resolved. Strengthening internal controls is a vital step following the identification of a breach. This involves reviewing and updating company policies, enhancing security measures, and providing additional training for staff to prevent future incidents. For example, after experiencing a compliance breach, a manufacturing firm might revise its safety protocols and invest in extensive employee training programs. These actions not only address the immediate issue but also build a stronger foundation for future compliance, ensuring that similar breaches are less likely to occur. By taking these comprehensive steps, businesses can effectively manage compliance breaches and reinforce their commitment to operating within regulatory frameworks.